The NBF market roundup includes a review of commodity markets. We hope you will find this useful in making informed buying decisions.

ORGANIC RICE

Organic Aromatic Rice:

Basmati paddy harvesting completed in India & Pakistan by the end of November. Pakistan crop likely to be record than last year when fields were washed away by floods. Organic Basmati paddy harvest was a bit delayed compared to conventional paddy. We are continuously procuring quality harvest from our farmers in project areas. Organic Basmati rice prices are under pressure due to big harvest from Pakistan. Pakistan Basmati exports are expected to reach record levels of 0.9 million tons this year.

However, paddy prices in India are trading higher than last year due to 2 major reason 1) Crop concerns 2) reduction in MEP (Minimum export price) . It allowed traders to buy large quantities for exports. Rice and Paddy prices in Pakistan have recovered from last year’s high due to ample crop. In Thailand fragrant rice prices have been flat to higher than last year. Demand for organic Basmati grades remained high this year due to India’s restriction on Non-Basmati exports to cool off the domestic prices. Nature Bio Foods works closely with farmers to procure finest quality of organic traditional Basmati rice and cater our customers across Europe and USA.

Organic Non Aromatic Rice:

Source USDA

In Thailand, harvest completed for this year and total crop size is expected to be 19.9 million tons which is ~one million tons lower than last year. The crop reduction is mainly attributed to offseason crop due to water availability issues. As Asian harvest comes to end, paddy arrivals in local markets are increasing day by day.

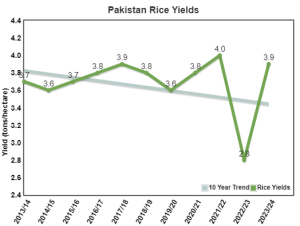

In India, as per government estimates total rice production is expected to be 4% down to 106 Million tons than last Kharif season due to uneven rains that caused havoc in growing areas. Whereas, Pakistan which was hit by flash floods last year recorded one of the lowest rice crop last year. However, this year crop was good and USDA expects it to be ~9 million tons i.e.63% higher than last year.

Non aromatic paddy prices are above last year in India & Thailand whereas its lower in Pakistan. In India, Govt. is continuously monitoring on domestic rice prices even after ban on exports. Recently, Govt. has asked rice companies to curtail retail prices in the country as inflation has been one of the key issues and it may have a major role in upcoming central elections that are due in 2024 first half.

However, Pakistan Non-Basmati exports are likely to rise due to good crop availability, lower prices, no export restrictions and ongoing India’s exports ban. Recently the attack on container ships in Red sea has caused delays for the shipments. The shipping lines are now using the alternate route of Cape of good hope for the shipments from Asia to Western countries. This new development will impact on the transit time by 10-15 days and approx. 75-100 USD per Mt increased cost for the buyers in the west. Nature Bio Foods have state of art facility in India and Netherlands to cater the needs of our customers. We have stocks with us in our both the facilities and can cater the customer needs timely.

ORGANIC FLAX SEEDS

Flax seed production in major exporting countries like Canada & Kazakhstan was not satisfactory due to poor weather conditions. Harvests in both these origins are complete for this year. Kazakh crop is reported to be with high moisture levels than normal and hence shipments are delayed. Heavy rains were seen during harvesting which kept the harvest delaying and impacting the moisture and other quality matters.

The third major origin, India witnessed sowing of the crop in November. The area sown as per Indian Govt is 254 Thousand hectares against 232 thousand ha. last year till 15th December. Temperature has started dropping in states of Madhya Pradesh, Uttar Pradesh, Jharkhand & Chhattisgarh where flax is grown. This should be beneficial to the crop growth.

Prices in Canada remained stable in November & December. Whereas, Kazakh flax prices were trading higher. In India prices started increasing from October and are still likely to be bullish till the arrival of next crop in March. In Europe, India’s share for flax seed supplies is more than 50% and even increasing. NBF holds the leadership position of Export of these Organic Flax Seeds for 4 consecutive years. Nature Bio Foods have stocks present in our India & Netherlands facility to offer for our customers.

ORGANIC SOYBEAN / SOYABEAN MEAL

India soybean harvest is complete. Africa soybean second season harvest even known as mini season has started in Uganda from 4th week of December. Nature Bio Foods owns an organic meal processing facility in Uganda and crush organic soybean for producing protein-rich organic soya meal. NBF works closely with farmers in Uganda to produce certified organic soybeans and then process it for soymeal production. As of now we have started procurement from farmers and expect the process to accelerate in January month.

Argentina govt. last week has devalued its currency by more than 100%. This move is likely to favour Argentina meal exporters and shall create pressure on conventional meal prices. However, organic soymeal prices may be cushioned from this as organic meal producers are limited than conventional meal manufacturers.

High demand from US & EU countries is seen in November& December month. Indian soymeal is struggling to be sold in the US markets due to anti-dumping duties laid by the US Govt. So now Africa is emerging as one of the key origins for organic soymeal supplies.

ORGANIC LENTILS

North American countries (Canada & USA) have seen drop in production due to heat waves that lasted during the sowing period this year. In India Lentils /pulses sowing for Rabi season has been completed. Pulses sowing is done in two seasons 1) Kharif (June-July) 2) Rabi (Nov-Dec). This year Kharif season was below average for pulses and in Rabi season total sowing is down by 8% as of 15th Dec as per Govt figures.

Brown lentils area sown is ~ 167 thousand ha and similar to last year. However, the area drop is seen in other lentils (Mung beans & Black Lentils) Winters has started to set and conditions are favorable for the crop development. Indian Govt. has hiked lentils Minimum support price (MSP) of brown lentils by ~9% than last year. This is the highest increment in MSP among all the winter season crops (Rabi crops) Nature Bio Foods works closely with farmers and have been a leading supplier of Brown/ Red Lentils from India.

ORGANIC SUGAR

India has restricted sugar exports to cool off the domestic prices in global sugar market, where India is largest exporter after Brazil has disrupted the global balance sheet due to Indian Govt.’s export ban. Lower rains in India due to El-Nino conditions in rainy season impacted on sugarcane development and yields are likely to drop by 25-30% than last year. Similarly, Thailand crop is also likely to be lower due to poor rains.

Crushing season in Asian countries have already started and will end up by March-April. Nature Bio Foods works with farmers in India for organic sugarcane has stocks to offer from our Rotterdam facility and buyers can reach us to secure their quantities.

ORGANIC CASHEW

Cashew prices in export markets are steady. Demand for Christmas & new year was seen in November & December. Africa is now emerging as new processing hub for cashew and buyers look for African cashews after Vietnam as both the origin offers cheaper cashews.

However, Indian cashews are preferred over Vietnam cashews for its quality & Taste. Enquiries for Indian cashew has started increasing and NBF are ready to offer organic cashews from our certified farms. Nature Bio Foods will be happy to have fixed contracts for organic Indian cashew supplies from now onwards.

ORGANIC CHICKPEAS / GARBANZO BEANS

Chick pea production was seen impacted by weather in Turkey & Australia who are the major exporters to the global markets. In India this is the sowing and crop growth phase time for Chick peas. Sowing started by November second half. However as per govt. figures the total area under gram (Kabuli + desi Chana) is ~10% lower against last year. Poor rains in monsoon period made the rain fed farmers to avoid sowing this Rabi season. Recent rains have been seen in the growing areas and now temperature have also cooled down providing better conditions for crop development.

Prices have been seen in bullish momentum in Canada, Australia, Turkey and India. Nature Bio Foods imports organic chick peas from India and Turkey and has stocks available in Netherlands

ORGANIC SESAME SEEDS

Due to a poor Latin American harvest and a dry pipeline, sesame prices continue to rise. We at our Uganda facility have procured quantities from our project farmers. India sesame exports are currently seen for the Oceania countries. India’s exports to Europe has not still not seen. However, NBF is working with the CBs to comply with all standards to initiate the Organic Soymeal exports to EU.

ORGANIC QUINOA

Peru & Bolivia’s poor crop harvest has disrupted the global Quinoa pipeline, which has driven buyers to aggressively search for origins to secure supplies. Phosphonic acid is one of the key issues and hence EU compliant material is again a big hurdle amid this shortage. India crop is expected by March till then prices are likely to remain strong. Buyers can connect with NBF to cover their requirements with us in this scenario.

ORGANIC CHIA

Uganda Chia harvest has started and we are procuring organic chia seeds from our farmers there. Latin American harvest (Paraguay, Bolivia) completed in September. Nature Bio Foods already sourced Chia from farmers in July and started buying this month as stated earlier. Low crop availability and dry pipeline are keeping the prices in bullish trend. NBF is actively engaged with the farmers for organic chia seeds and buyers can start securing quantities with us.

ORGANIC AMARANTH

In recent weeks, organic amaranth prices have seen a sharp rise and are expected to rise in the future. Stocks are limited in India since the season has ended. Festive demand in India in coming months to keep prices on higher side. Exports enquires are also rising in Europe & America. NBF has currently stocks to offer and buyers can connect with us to cover their requirements with us in this scenario.

ORGANIC PSYLLIUM HUSK

Sowing for new crop 2023-24 have completed this month in Rajasthan & Gujarat states of India. Psyllium seeds prices have now come down to last year levels after hitting historic high in July,2023. Nature Bio Foods is only working on strategic tie-ups with fixed contracts. NBF will also have steam sterilized Psyllium husk available at our Netherlands facility to offer to our customers readily.

Sowing for new crop 2023-24 have completed this month in Rajasthan & Gujarat states of India. Psyllium seeds prices have now come down to last year levels after hitting historic high in July,2023. Nature Bio Foods is only working on strategic tie-ups with fixed contracts. NBF will also have steam sterilized Psyllium husk available at our Netherlands facility to offer to our customers readily.