The NBF market screener includes a review of commodity markets. We hope you find this useful in making informed buying decisions.

ORGANIC RICE

Organic Aromatic Rice: Organic Basmati Rice prices remained stagnant in June. After seeing a decline in May, sellers resisted further drops. As anticipated in our last review, the prices found support and traded flat throughout June.

Organic Aromatic Rice: Organic Basmati Rice prices remained stagnant in June. After seeing a decline in May, sellers resisted further drops. As anticipated in our last review, the prices found support and traded flat throughout June.

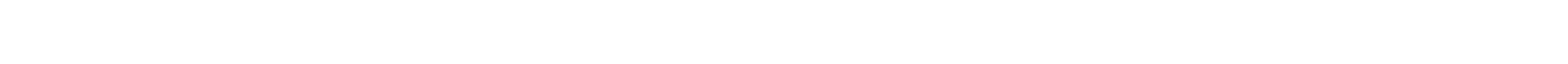

Organic Non-Aromatic Rice: The FAO Rice Index for May 2024 remained at 137 points, which is 1.3% up from April values and 7.5% higher than in May 2023. Non-aromatic rice prices have followed the trend seen in aromatic rice, remaining stagnant for the last two months. However, rising freight rates are now driving up prices. Demand is strong from India for organic non-basmati rice due to restrictions on conventional non-basmati exports.

Key Factors for Organic Basmati & Non-Basmati Prices in the Next Few Months:

Freight Rates Skyrocketed in June: Freight rates saw a significant hike in June, driven by Chinese demand, especially from the USA. The US government recently announced anti-dumping duties on various Chinese products, likely to be implemented from August 1. This raised an alarm for Chinese importers, leading to a sudden surge in container demand. Freight rates to Europe and the USA increased by 10-30%. The Red Sea crisis and conflicts in Ukraine and the Middle East have kept the shipping industry on high alert. The increase in freight costs has impacted prices, likely keeping organic Basmati prices higher.

Start of Sowing in Asia: The monsoon arrived on time in India, bringing rains in June to South and Central India and late June to North India. Paddy sowing has started in India and Pakistan. Both governments expect a good paddy crop this year due to timely rains. Nature Bio Foods has state-of-the-art facilities in India and the Netherlands to meet customer needs, with stocks available in both locations.

Elections in India & Anticipated Policy Changes for Exports: General elections concluded in India, and results were announced by June 4, 2024. The NDA government was re-elected, likely continuing current policies. The BJP, the largest party, failed to secure a complete majority, now relying on other parties to maintain government stability. This will require the ruling BJP to consider other parties’ views, especially on farmers’ income and consumer prices (inflation). The government has assured the continuation of free rations, with rice being a major component. Decisions on exports will likely depend on the crop harvest in March/April.

Pakistan Exports: In contrast to India’s policy, the Pakistan government plans to continue a strong rice export campaign for the 2024-25 season. With a better crop last year and good prospects for the coming season, they expect the rice industry to earn record foreign exchange. Inflation issues persist in Pakistan, but the economic situation necessitates maximizing foreign exchange earnings. Despite high costs for farmers and processors, a higher crop yield is expected.

Thailand Off-Season Harvest: Thailand’s off-season harvest began in June, with production expected to be better than last year. The Thai government expects similar crop production (~20 million tons) in 2024/25 as in 2023/24. Prices for organic white and fragrant rice remain steady. Nature Bio Foods has state-of-the-art facilities in India and the Netherlands to meet customer needs, with stocks available in both locations.

ORGANIC FLAX SEEDS

Organic Flax Seeds Prices: Organic flaxseed prices have risen in major origins like India and Kazakhstan. Poor crops last year in Kazakhstan and the off-season in India have tightened availability. Prices have jumped by 7-10% in the last few months.

Import Duties on Russian Flaxseeds in Europe: From July 1, the EU imposed a 50% import duty on various Russian products, including oilseeds and oil meals. This will likely eliminate Russian flax availability, shifting demand to Kazakhstan and Indian flaxseeds.

Poland Bans Ukrainian Trucks Without International Permits: Poland is implementing strict transport permit requirements for Ukrainian trucks, reducing non-monitored truck flows into the EU. This will also make importing Kazakh products into the EU more challenging.

Off-Season in India and Stockist Activities: India is currently in the off-season of its crop cycle, with the next sowing due in November and the harvest in March. Stockists are holding on to limited supplies, waiting for better prices. Prices have firmed up in recent months and are likely to stay higher until the next crop arrives.

Kazakhstan Harvest Near: After a small crop in 2023, Kazakhstan expects better prospects for the 2024 harvest starting in August. Industry experts predict farmers will increase the area under flaxseed cultivation due to underperforming competitive crops. Given the global scenario, prices are likely to remain strong, and buyers are advised to start covering their requirements. Nature Bio Foods has stocks available in India and the Netherlands.

ORGANIC SOYBEAN / SOYBEAN MEAL

Global Prices: Global organic soybean and meal prices remained stagnant in the last couple of months. American feed buyers were active in sourcing and attempted to secure forward bookings at lower prices. However, limited supplies and high costs of beans and freight have kept prices firm.

Harvests: The organic soybean harvest from West Africa is complete, but suppliers from Togo, Nigeria, Ethiopia, and Ghana have limited supplies compared to demand. The East Africa harvest is upcoming, with buyers closely watching the outcome.

Supplies: Global supplies are now expected from East Africa and India. India faces anti-dumping duties from the USA, a major buyer of organic soymeal. Conventional soybeans are abundant, but organic bean prices are rising and are likely to continue due to limited supplies and high demand. High ocean freight rates are also contributing to rising prices.

Nature Bio Foods Uganda: Nature Bio Foods Uganda owns an expeller-based soymeal plant and currently serves customers in the USA and Europe. We are preparing for robust procurement and booking inventory for customers.

ORGANIC CASHEW

Price Increases: Organic cashew kernels and raw cashew nut (RCN) prices remained 20-40% higher due to poor crops in Africa, India, and Vietnam. Ivory Coast, a major supplier, restricted RCN exports to protect local processors, causing supply struggles in India and Vietnam and further fueling price increases.

India and Vietnam: In India, cashew kernel prices jumped by 25-30% due to a poor domestic crop and limited RCN supplies from Africa. Similar conditions are seen in Vietnam, with a poor domestic crop, limited RCN supplies, and increased freight rates resulting in a 25-30% hike in prices. The EU is facing shortages and eagerly awaiting shipments from Vietnam, Africa, and India. This situation is expected to continue for the next few months.

Nature Bio Foods Projects: Nature Bio Foods has projects in India offering organic Naturland, Fairtrade, and Bio Suisse certified cashew nuts. We are ready to sign fixed contracts for organic Indian cashew supplies.

ORGANIC SUGAR

Market Conditions: Organic cane sugar prices remained steady in the last couple of months in the EU and USA. Imports from Latin American countries and Africa were normal. Demand for Organic Extra Light / Golden Light sugar remained high, with prices ranging from 1200-1300 Euros FCA Netherlands.

India: India, a major supplier to the EU, has restricted sugar exports due to internal requirements, tightening the supply chain. The Indian cane harvest is complete, but the government is unlikely to open exports due to high domestic prices.

Latin America: The Latin American cane harvest is ongoing, but drought conditions in recent months are expected to reduce Brazilian production numbers. The ICE July contract expired near 20.3 cents, with October trading near 20.2. Industry experts anticipate tight supplies if India does not resume exports, potentially increasing prices.

Nature Bio Foods Stocks: NBF has sugar stocks available at our Netherlands facility, and buyers can secure quantities promptly.

ORGANIC SESAME SEEDS

Production and Prices: Organic sesame production was limited last year, making it difficult for buyers to secure compliant material. Prices slightly declined from their peak after crops from West Africa and Latin America were harvested. The South American (Argentina and Bolivia) harvest is complete, with the next harvest expected from East Africa (Uganda and Togo). High demand is likely to keep buyers active in these markets.

Compliance Challenges: Suppliers from India have avoided providing supplies to the EU due to compliance challenges, keeping overall supplies in the EU tight. Prices spiked to 2800-3000 Euros/MT but have since cooled off. Lower carryover and poor availability have kept prices firm. High demand and lower stock levels have persisted in the organic sesame industry for the past year.

Nature Bio Foods Projects: Nature Bio Foods has projects in Africa (Uganda) and has booked some stocks for customers. Buyers can contact us for further sales.

ORGANIC LENTILS

Production and Prospects: Organic lentil production in India was limited last year, with low carryover seen. Timely monsoons have started the sowing of the Kharif season, with good rains expected to improve production prospects compared to last year. In contrast, production prospects in Turkey have declined due to recent heat wave conditions across Europe, likely limiting supplies and driving prices up.

Nature Bio Foods Offers: Nature Bio Foods offers lentils from India and Turkey, available from our Netherlands warehouse on a prompt basis.

ORGANIC QUINOA

Organic Quinoa prices have been hiking this season. The crop from India was limited, and less carryover in destination markets has been seen. Harvesting is currently in Peru and almost completed in Bolivia. The crop is reported to be better than last year. However, lower carryover has still kept prices trading as high as 3500 Euros/MT CIF Europe.

The situation in India is unchanged from the last two months. Indian Quinoa prices are still cheaper than Latin American countries’ prices, hence the constant demand for Indian Quinoa. However, product availability has been a challenge so far. We expect prices to improve from here on. NBF has stocks in India and the Netherlands, and buyers can connect with us for any requirements.

ORGANIC CHIA

Low crop availability and a dry pipeline are keeping prices in a bullish trend. Indian Chia seed prices have increased by 20-25%. The Chia harvest has been completed in Paraguay, Peru, and India in the last 3 months. The Uganda Chia harvest has also been completed, and we have covered organic chia seeds from our farmers there. However, robust demand has caused prices to start increasing again.

NBF is actively engaged with farmers for organic chia seeds, and buyers can start securing quantities with us from our India and Uganda origins.

ORGANIC AMARANTH

Organic Amaranth prices witnessed a sharp rise and then fall in the last couple of months. Dry pipeline stocks and upcoming harvests kept prices firm. However, the harvest in India completed in March, and the increase in arrivals kept prices lower.

Prices are still trading higher than last year. NBF currently has stocks to offer, and buyers can connect with us to cover their requirements in this scenario.

ORGANIC PSYLLIUM HUSK

The Psyllium seed harvest was completed in India without any weather disruptions. Crop conditions were excellent, resulting in better quality in the new arrivals in the local markets from farmers. Psyllium seed prices, after cooling off in April during harvesting, gained momentum again in May and June.

The Psyllium seed harvest was completed in India without any weather disruptions. Crop conditions were excellent, resulting in better quality in the new arrivals in the local markets from farmers. Psyllium seed prices, after cooling off in April during harvesting, gained momentum again in May and June.

High freight rates are likely to keep costs for buyers higher. NBF has Psyllium husk available at our Netherlands facility, ready to offer to our customers.