The NBF market screener includes a review of commodity markets. We hope you will find this useful in making informed buying decisions.

ORGANIC RICE

Organic Aromatic Rice:

Paddy harvest for 2023 has started in India, Pakistan & Thailand. We are busy buying organic aromatic paddy from our farmers in the project areas in India. We are also witnessing arrivals in the local markets increasing day by day as farmers are rushing to sell and meet their cash demand for the ongoing Festive season.

Quality of this harvest looks satisfactory and we should be able to keep continue serving finest aromatic Basmati grains to our customers.

On price, new season arrivals prices are trading lower than last year in India. Better crop prospects have been seen in Pakistan compared to last year when flashfloods created havoc.

Demand from Europe and USA for traditional basmati rice has seen a surge and food companies are trying to secure the quantities. Specially the rarity of Organic Indian Traditional basmati rice, also known as true basmati, makes it very precious and authentic basmati untainted by the tide of modern agronomy. Procurement from food companies is ongoing, nearly 20-25% of procurement have been done in organic segment till now.

Nature Bio foods are offering competitive prices in Basmati and we have seen demand increasing in western markets.

Organic Non Aromatic Rice:

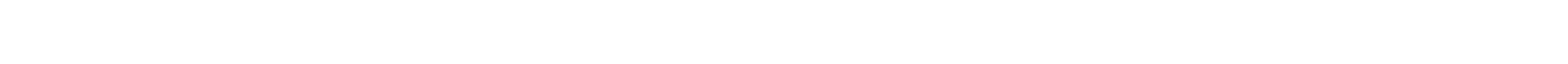

The FAO All Rice Price Index is at 27.8% high than last year Sept Value. However, this has cooled by 0.5% from August 2023. India prices remained firm due to festive demand amid harvest commencement.

India Parboiled prices for exports traded higher as Non-basmati exports have been banned. Thai white rice 5% prices cooled down due to arrival pressure of new crop. Indian Govt. hiked Non-Basmati Paddy Prices (MSP) by 7% than last year. This has resulted in price hike. Govt’s Export ban on Non-Basmati rice has further fuelled prices across international markets.

In India, Central elections are due in mid of 2024 and hence Govt. is cautious on inflation and hence have restricted exports of major commodities like Wheat, Rice (Non-Basmati-Conventional) & Sugar (Organic & Conventional). We expect this restriction to continue till 2024. However organic rice exports are still allowed and NBF is catering customers in both (Basmati & Non-Basmati) segments.

In Italy, rice farmers have reduced organic rice acreage this year. Crop conditions were satisfactory this season. Italy serves majority of EU rice needs. Imports of organic rice from Non-EU countries is rising as customers are preferring organic rice.

Internationally Ocean freights have been down remarkably currently and customers can take advantage of this in near future.

Nature Bio Foods have state of art facility in India and Netherlands to catering the needs of our customers proudly.

ORGANIC FLAX SEEDS

Flax harvesting in Saskatchewan which is the major flax growing area in Canada has been completed. Prices have improved by ~10-15% after August. Earlier estimates of lower crop due to poor crop conditions helped the prices. In Kazakhstan, also reports are there about near completion of harvest. Kazakh crop is reported to be with high moisture levels than normal and hence shipments are delayed. Heavy rains were seen during harvesting which kept the harvest delaying and impacting the moisture and other quality matters.

India linseed sowing started by this month and we can comment better about change in crop area and crop health by next edition of this market screener. Crop shall be available by February March.

Unfavorable weather conditions have impacted the crops in Canada & Kazakh and same is expected to keep the supplies tight.

Nature Bio Foods has been able to manage its stock positions and now offering Organic Flax at significantly competitive prices. The Situation offers opportunities around Indian Organic Flax in Europe at current prices. It is estimated that EU has 50% share of Indian Flax and is increasing year on year.

NBF holds the leadership position of Export of these Organic Flax Seeds for 4 consecutive years.

ORGANIC SOYBEAN / SOYABEAN MEAL

Soybean harvest in India is completed for this season but Indian Organic Farmers are struggling to find their market in USA due to AD / CVD challenges and in EU due to tough norms created by CB’s. The market was stable for last few months and traders have made it picked up suddenly.

Uganda harvest of April 2023 was a success with many players jumping on the opportunity of securing the quantities. High Demand and Low output give a significant advantage to the farmers. Nature Bio Foods is closely working with farmers in this region and committed to source a big chunk in upcoming harvest of December 2023. A sudden demand has erupted from USA and EU in November 2023.

Nature Bio Foods owns an organic meal processing facility in India and Uganda and crush organic soybean for producing protein-rich organic soya meal.

ORGANIC BROWN / RED LENTILS

In last month’s edition, we mentioned that Canada’s lentil production may be affected by the heat wave. There is a possibility that production will drop by 20%. Similarly, lentils area has dropped in USA due to weather concern.

India total pulses production is expected to take a hit down due to lower sowing area and erratic monsoon. In India Brown lentils sowing has started and we have to wait till November end to understand the actual acreage under lentils. Winters has started to set and conditions are favorable for the sowing and germination.

Indian Govt. has hiked lentils Minimum support price (MSP) of brown lentils by ~9% than last year. This is the highest increment in MSP among all the winter season crops (Rabi crops)

India-Canada diplomatic issues are still continuing and this has impacted on lentils supply chain. This development is likely to keep the prices in bullish momentum. Since the new crop is 6 months out, it is recommended to cover all stocks till Mid next year

Nature Bio Foods works closely with farmers and have been a leading supplier of Brown/ Red Lentils from India.

ORGANIC SUGAR

After India’s restriction on exports, sugar prices went on rally and are trading near record highs. In global sugar market, where India is largest exporter after Brazil has disrupted the global balance sheet due to Indian Govt.’s export ban.

Lower rains in India due to El-Nino conditions in rainy season impacted on sugarcane development and yields are likely to drop by 25-30% than last year. Similarly, Thailand crop is also likely to be lower due to poor rains.

Crushing season in Asian countries have already started and will end up by March-April.

Nature Bio Foods works with farmers in India for organic sugarcane has stocks to offer from our Rotterdam facility and buyers can reach us to secure their quantities.

ORGANIC CHICKPEAS / GARBANZO BEANS

Canada’s harvest is complete. Due to improved prices last season, area under cultivation increased by 20%.

There are estimates of lower supplies from Turkey due to heavy rains. Australian markets are already experiencing record high prices as a result of poor crops amid unfavorable weather conditions. Australian crop is expected to be near ~500 Thousand tons against estimate of 540 Thousand tons. Tight supplies to keep prices in bullish momentum.

There are still uncertainties around Phosponic acid presence which occurs naturally in chick peas and requires very careful selection and segregation process.

Nature Bio Foods imports organic chick peas from India and Turkey and has stocks available in Netherlands.

ORGANIC SESAME SEEDS

Sesame prices continue to rise due to a poor Latin American harvest and a dry pipeline. Sesame harvest has been completed in African (Uganda) & our procurement team has secured some quantities.

India new crop harvesting is almost complete and there are exports demand seen in the market. Festive season in India is also pushing the prices higher unfortunately Organic Sesame from India still is not been done. NBF is working with the CBs to comply with all standards to initiate the Organic Soymeal exports to EU.

ORGANIC AMARANTH

In recent weeks, organic amaranth prices have seen a sharp rise and are expected to rise in the future. Stocks are limited in India since the season has ended. Festive demand in India in coming months to keep prices on higher side. Exports enquires are also rising in Europe & America.

NBF has currently stocks to offer and buyers can connect with us to cover their requirements with us in this scenario.

ORGANIC CHIA

Latin American harvest (Paraguay, Bolivia) completed in September. Weather is the most important factor for chia seeds production and quality of the produce. Uganda Chia harvest is expected by November end. Nature Bio Foods already sourced Chia from farmers in July and shall be buying in upcoming harvest.

Low crop availability and dry pipeline are keeping the prices in bullish trend. NBF is actively engaged with the farmers for organic chia seeds and buyers can start securing quantities with us.

ORGANIC CASHEW

Cashew prices in export markets are steady. However, Diwali festive demand in India & overseas to support the prices in near term. Enquiries for Indian cashew has started increasing and NBF are ready to offer organic cashews from our certified farms. Indian cashews are preferred over Vietnam cashews for its quality & Taste.

Nature Bio Foods will be happy to have fixed contracts for organic Indian cashew supplies from now onwards.

ORGANIC QUINOA

Poor crop harvest in Peru & Bolivia has disrupted the global pipeline for Quinoa and buyers are aggressively searching for the origins to secure quantities. There are cross country trades happening due to short crop. Prices are running record high.

Phosphonic acid is one of the key issues and hence EU compliant material is again a big hurdle amid this shortage.

India crop is expected by March till then prices are likely to remain strong. Buyers can connect with NBF to cover their requirements with us in this scenario.

ORGANIC PSYLLIUM HUSK

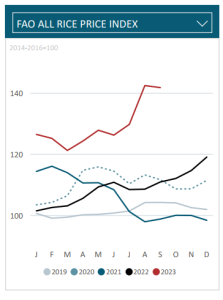

Sowing for new crop 2023-24 have started and likely to get completed in this fortnight. Over the past couple of months, psyllium prices have corrected and inching towards earlier levels as new harvest is coming closer. Nature Bio Foods is only working on strategic tie-ups with fixed contracts done in pre-sowing period i.e. before October last week.

Sowing for new crop 2023-24 have started and likely to get completed in this fortnight. Over the past couple of months, psyllium prices have corrected and inching towards earlier levels as new harvest is coming closer. Nature Bio Foods is only working on strategic tie-ups with fixed contracts done in pre-sowing period i.e. before October last week.